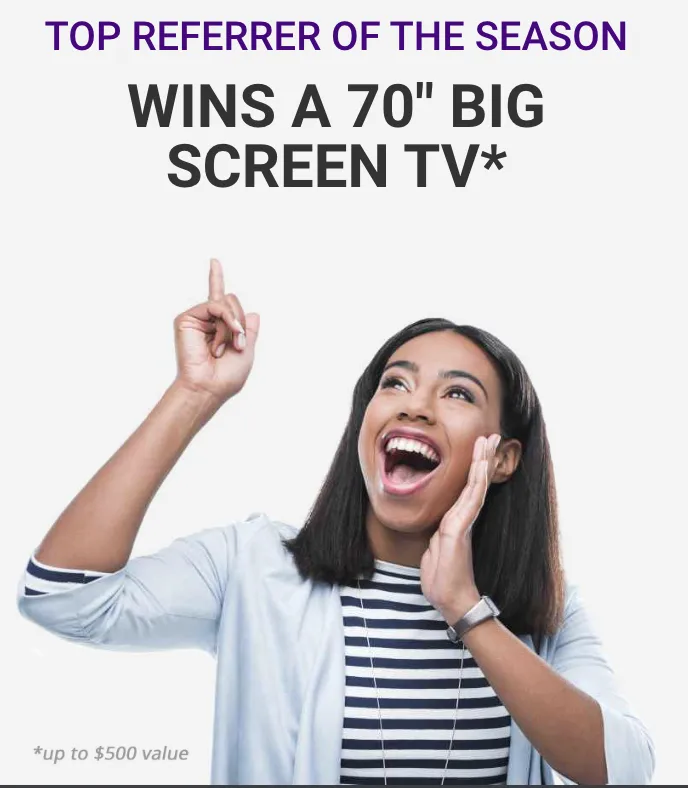

Tax shield services

Personal and business tax preparations Blog

Our mission is to guide you on information about relevant tax related issues. Our blog delves into various tax topics including personal and business taxes, referral and bonus programs, business tax planning and audit support.

Personal tax preparation includes individuals filing their income, credits and deductions to the IRS by using e-filing or paper return via a tax preparation service. Business tax preparation relates to either self-employed individuals or entities submitting their financial information, including deductions, income and expenses to the tax authorities via tax firm. By law, it’s is mandatory that both individuals and businesses file their taxes every year to the IRS.

A Guide for Income tax preparation & Advances

What To Do If Your Vehicle Has Hail Damage

Receiving a tax advance as an individual taxpayer brings the notable advantage of accessing your hard-earned money promptly as an individual taxpayer. Holiday advances provide momentous advantage for tax clients - flexibility. Whether you prefer to receive your funds via direct deposit, a prepaid card, or even as a check, tax providers typically offer various options to suit your needs. This level of convenience allows you to access your money in a way that works best for you.

Refund advances are also beneficial for small business clients that pays self-employment taxes. A tax advance can provide the essential funds needed to cover expenses such as inventory purchases, marketing initiatives and other unexpected expenses during the holiday. A Refund advance offers an opportunity to bridge these gaps by providing access to funds when they're most needed. By utilizing a tax advance wisely, small businesses can seize opportunities that arise throughout the year without having to wait till the tax season is over.

Information About Referral program and Bonuses

In the world of income tax preparation process, maximizing savings by strategizing and optimizing various techniques should be of highest priority. One of the non-utilized tactics often overlooked by tax clients is the power of referrals. Referrals can lead to significant savings through bonuses and discounts on tax preparations. This blog post covers the benefits of leveraging referrals in the realm of the tax preparation process and how it can contribute to your financial needs.

Referrals also help connecting with building a trustworthy relationship with tax professionals. This can open doors to other bonus programs and additional services. Some firms increase their incentives for referrers by increasing their cash rewards after bringing certain clients to the business. Referrers can also gain access to valuable additional services on education on retirements, savings, financial plannings and investment strategies from the tax firms. This education can also lead to a long-term financial success for tax clients.

How To Find The Right Business tax preparation & Audit support

It is paramount for business tax clients to understand the distinct tax implications associated with different types of business structures (such as LLC, sole proprietorship, partnership, limited partnership, Non-profit organization and corporation). This helps business owners to optimize tax benefits and ensure proper compliance. The structure and type of your business play a momentous role in determining your tax obligations. Expert advice is invaluable in navigating the complex landscape of business tax preparation and minimizing the risk of oversights or errors. It is recommended for business owners to assess various tax places that understands the complexities of this business structures.

Different tax firms provide businesses promote financial health, strategic decision-making, and adherence to continuously evolving tax laws from tax authorities like the IRS. This allows taxpayers to tailor strategies and make business tax planning easier and faster. Take notes from tax locations on specific tax obligations that apply to your business and helps you strategize and maximize your deductions.

Contact Us

Service Hours

Social Media

Monday - Friday: 10:00 AM - 6:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Tax shield services

Personal and business tax preparations Blog

Our mission is to guide you on information about relevant tax related issues. Our blog delves into various tax topics including personal and business taxes, referral and bonus programs, business tax planning and audit support.

Personal tax preparation includes individuals filing their income, credits and deductions to the IRS by using e-filing or paper return via a tax preparation service. Business tax preparation relates to either self-employed individuals or entities submitting their financial information, including deductions, income and expenses to the tax authorities via tax firm. By law, it’s is mandatory that both individuals and businesses file their taxes every year to the IRS.

Receiving a tax advance as an individual taxpayer brings the notable advantage of accessing your hard-earned money promptly as an individual taxpayer. Holiday advances provide momentous advantage for tax clients - flexibility. Whether you prefer to receive your funds via direct deposit, a prepaid card, or even as a check, tax providers typically offer various options to suit your needs. This level of convenience allows you to access your money in a way that works best for you.

Refund advances are also beneficial for small business clients that pays self-employment taxes. A tax advance can provide the essential funds needed to cover expenses such as inventory purchases, marketing initiatives and other unexpected expenses during the holiday. A Refund advance offers an opportunity to bridge these gaps by providing access to funds when they're most needed. By utilizing a tax advance wisely, small businesses can seize opportunities that arise throughout the year without having to wait till the tax season is over.

Information About Referral program and Bonuses

In the world of income tax preparation process, maximizing savings by strategizing and optimizing various techniques should be of highest priority. One of the non-utilized tactics often overlooked by tax clients is the power of referrals. Referrals can lead to significant savings through bonuses and discounts on tax preparations. This blog post covers the benefits of leveraging referrals in the realm of the tax preparation process and how it can contribute to your financial needs.

Referrals also help connecting with building a trustworthy relationship with tax professionals. This can open doors to other bonus programs and additional services. Some firms increase their incentives for referrers by increasing their cash rewards after bringing certain clients to the business. Referrers can also gain access to valuable additional services on education on retirements, savings, financial plannings and investment strategies from the tax firms. This education can also lead to a long-term financial success for tax clients.

How To Find The Right Business tax preparation & Audit support

It is paramount for business tax clients to understand the distinct tax implications associated with different types of business structures (such as LLC, sole proprietorship, partnership, limited partnership, Non-profit organization and corporation). This helps business owners to optimize tax benefits and ensure proper compliance. The structure and type of your business play a momentous role in determining your tax obligations. Expert advice is invaluable in navigating the complex landscape of business tax preparation and minimizing the risk of oversights or errors. It is recommended for business owners to assess various tax places that understands the complexities of this business structures.

Different tax firms provide businesses promote financial health, strategic decision-making, and adherence to continuously evolving tax laws from tax authorities like the IRS. This allows taxpayers to tailor strategies and make business tax planning easier and faster. Take notes from tax locations on specific tax obligations that apply to your business and helps you strategize and maximize your deductions.

248-955-2247

Service Hours

Monday - Friday: 10:00 AM - 7:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Social Media